Brexit

Visit our Brexit page here and read the latest updates

Brexit

In the light of Brexit that is approaching shortly, we would like to update you with the following information. We do this so that you are well informed what to do after the Brexit, as well as to finalize our own preparation here at Mainfreight.

Advantages of Mainfreight handling your customs formalities

When exporting goods to the UK after the first of January 2021, customs formalities will be required.

With our specialized know-how we are capable to offer solutions to all your customs-related needs that go along with your logistics flow. Mainfreight is AEO-certified which means that shipments subject to customs formalities will know a smooth and efficient handling with us. All you need to do is send us the invoice and packing list – digital of course – and Mainfreight can handle all customs formalities for you.

Partner in the UK

For network shipments (1-5 pallets), Mainfreight advises you and your consignee to engage with our partner Davies Turner to handle import documents. Our daily shuttles from and to Davies Turner will be supported by a consolidated Transit document which means import declarations do not have to be made at the point of entry in the UK but only when the shipments are at our partner’s depot in Dartford. This way, we expect to circumvent any delays at the border.

Davies Turner relies on an in-house customs department which means your shipment can be delivered without any trouble. The advantage of engaging in a combination of working with Mainfreight – Davies Turner means that we already prepare the necessary documents by sharing data before the shuttle arrives.

Your client/consignee in the UK can already contact Davies Turner in order to take care of customs import formalities (road@daviesturner.co.uk) and with Mainfreight London for direct and full trailer loads (sales@uk.mainfreight.com).

Direct representation

If you decide to choose Mainfreight as your partner for the creation of your customs formalities, we ask you to carefully read the attached document ‘DV ENG’, fill it out, and send it back to your accountmanager (signed).

You will notice this document asks for an EORI-number. Such number is mandatory for exporting/importing to/from the UK as per January 1st. We strongly advise you to verify of you have this registration already in place, and if not to apply with the proper authorities.

If you would choose to let a third party take care of your customs formalities, a small fee will be applicable due to the fact that that Mainfreight still needs to process these forms along with your shipment, as well as to include your shipment on the consolidated transit document.

The precise amounts of these fees will be communicated with you in a next news letter.

Incoterms

In our previous communication we informed you briefly on the Incoterms that Mainfreight will apply for

shipments to and from the UK.

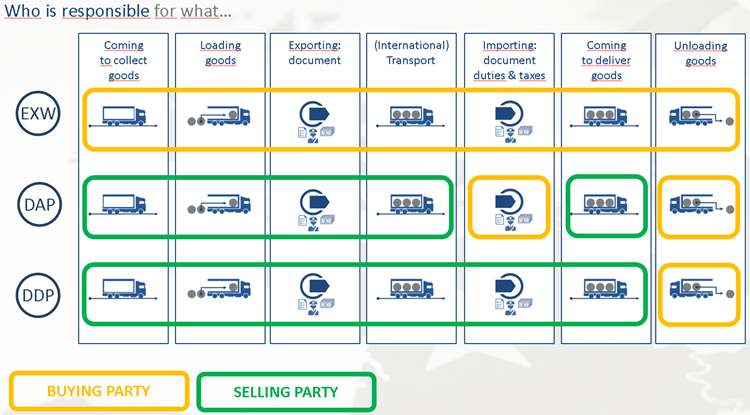

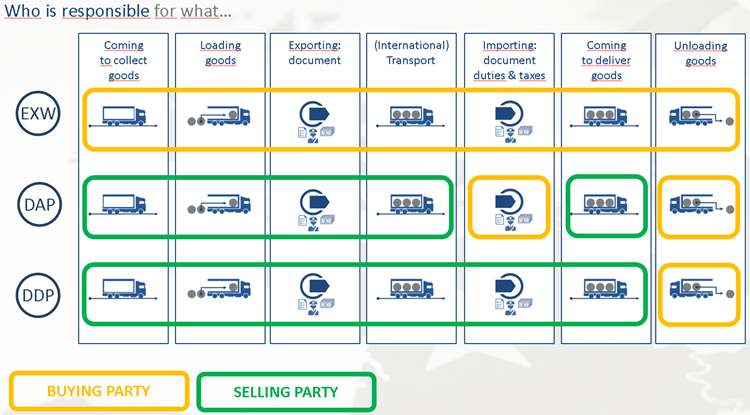

We will apply three Incoterms: DAP (Delivered At Place), DDP (Delivery Duties Paid) and EXW (Ex Works).

Each of these has a different impact on the flow of customs formalities and the responsibility. We would like to refer to the schedule which is added under this paragraph. For a more detailed explanation, don’t hesitate to contact your account manager.

After a query with our customers, we conclude that most shipments will be handled in a DAP set-up. This is also the Incoterm that Mainfreight advises to all its customers: the seller takes care of the export declaration and the seller is responsible for any export licence or extra declarations, if necessary.

For import in the country of destination the buyer takes care of the import declaration and pays any import duties when applicable. Also, does the buyer apply for extra import documents or an import licence if necessary.

Correct and complete data

Starting January 1st, it will be of the utmost importance that you shipment contains all the necessary (and correct) data. This in order to be able to swiftly create the necessary customs formalities and process your shipment. Together we can minimize the risk of your shipment getting blocked somewhere along the supply chain. A good exercise is to already check under which HS-code (Harmonized System) your shipments can fall. Please be advised that there will be multiple HS-codes if your shipment does not consist of a single, homogenous good.

As for now, you can continue to ship to and from the UK as you are used to. When more information regarding the Brexit and the precise interpretation of the consequences becomes available, we will inform you of course.

Our Brexit website (https://www.mainfreight.com/nl-be/brexit-update-belgium) is fully updated with the latest information.

Do you have any further questions regarding Brexit? Please contact your accountmanager or our Brexit department: brexit@be.mainfreight.com.

FAQ and Direct Representative Form

Download here the presentation with the most frequently asked questions and the Direct Representative Form if you want to have your customs import or export declarations executed by Mainfreight.

Download

Brexit presentation

Download

Authorisation Form Direct Representative

Download

Checklist Commercial Invoice

Find the latest Brexit news and updates

Brexit Update 2 February 2021

After 3 weeks of Brexit transport to and from the United Kingdom (UK), we at Mainfreight are trying to optimize the process even further. For example, we see that if the importer's contact details are clearly stated in the shipment or on the invoice, the handling of the shipment on the UK side runs many times smoother. We therefore make an urgent request that, in addition to the importer's contact details which are already mandatory, the importer's email address and telephone number are clearly stated in the shipment (or on the invoice).

In addition, as a customer you can speed up the process in the UK even more by providing us with the 10-digit HS code instead of the 8-digit HS code. The Chamber of Commerce writes the following about this:

"Each country individually can extend the HS code of a product. Within the EU we have 8-digit codes for goods that you export from the EU (HS codes supplemented with 2 digits). When importing goods into the EU, you need 10-digit codes (HS codes supplemented with 4 digits). These codes are also called commodity codes."

So for an export, an 8-digit HS code is sufficient, but for an import, a 10-digit HS code must be supplied.

Finally, before you book the shipment with us and submit the data to us, check that your invoice and packing list meet all the requirements and that the data in the digital shipment is the same as the data on the invoice/packing list so that we can further take care of declaring your goods. To know what information must be on your invoice and packing list, we have once again added the completed checklist.

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@be.mainfreight.com.

In addition, as a customer you can speed up the process in the UK even more by providing us with the 10-digit HS code instead of the 8-digit HS code. The Chamber of Commerce writes the following about this:

"Each country individually can extend the HS code of a product. Within the EU we have 8-digit codes for goods that you export from the EU (HS codes supplemented with 2 digits). When importing goods into the EU, you need 10-digit codes (HS codes supplemented with 4 digits). These codes are also called commodity codes."

So for an export, an 8-digit HS code is sufficient, but for an import, a 10-digit HS code must be supplied.

Finally, before you book the shipment with us and submit the data to us, check that your invoice and packing list meet all the requirements and that the data in the digital shipment is the same as the data on the invoice/packing list so that we can further take care of declaring your goods. To know what information must be on your invoice and packing list, we have once again added the completed checklist.

Contact

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@be.mainfreight.com.

Brexit Update 19 January 2021

As you may have heard in the news last week, a number of carriers are currently no longer driving to the United Kingdom (UK). We as Mainfreight have decided to still offer daily transport to and from the UK. However, we do ask you as our customer to help us as much as possible for a smooth flow.

Mainfreight has gone through the first Brexit weeks. Unfortunately, we have noticed that not all customers are equally well prepared for the Brexit and this is creating increasing challenges for us. Because the documentation is often incomplete or because data in the digital shipment does not match the data on the invoice/packing note, our crossdock is full of shipments that cannot be shipped to the UK and our employees are very busy collecting the correct documentation to be able to send the shipments.

Due to the strict lockdown in the UK, many people are working at home and it is very difficult for our partner to handle the imports. Therefore we urge you to share the contact person, phone number, email address and GB Eori number of the importer in the UK. Partly by doing this we speed up the handling in the UK. Should the importer arrange customs clearance himself with another party, please also let us know clearly and share the contact details of this with us.

Before you book the shipment with us and provide us with the data, please check whether your invoice and packing list meet all the requirements and whether the data in the digital shipment is the same as the data on the invoice/packing list so that we can continue to declare your goods.

In order to know what information should be on your invoice and packing list, we have made a checklist below so you can check if everything is on your invoice:

Data shipper/exporter

Type & numbers / quantities of pallet type / boxes

Weights and dimensions: indicate gross and net weight separately (may also be indicated on the

packing list)

Country of origin / origin of goods

INCOTERM

Contact details of any customs agent used

The checklist above can also be downloaded here so you can print it out and tick it off again with each shipment. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we will not be able to ship your shipment to the UK. Your shipment will then be delayed.

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@be.mainfreight.com.

Mainfreight has gone through the first Brexit weeks. Unfortunately, we have noticed that not all customers are equally well prepared for the Brexit and this is creating increasing challenges for us. Because the documentation is often incomplete or because data in the digital shipment does not match the data on the invoice/packing note, our crossdock is full of shipments that cannot be shipped to the UK and our employees are very busy collecting the correct documentation to be able to send the shipments.

Due to the strict lockdown in the UK, many people are working at home and it is very difficult for our partner to handle the imports. Therefore we urge you to share the contact person, phone number, email address and GB Eori number of the importer in the UK. Partly by doing this we speed up the handling in the UK. Should the importer arrange customs clearance himself with another party, please also let us know clearly and share the contact details of this with us.

Before you book the shipment with us and provide us with the data, please check whether your invoice and packing list meet all the requirements and whether the data in the digital shipment is the same as the data on the invoice/packing list so that we can continue to declare your goods.

In order to know what information should be on your invoice and packing list, we have made a checklist below so you can check if everything is on your invoice:

Data shipper/exporter

- Name, address, place of residence

- EORI number

- VAT number

- Name, address, place of residence

- EORI number

- VAT number

- preferably specific, not generic (e.g. only the description "spare parts" is not specific enough)

- amount & corresponding currency

Type & numbers / quantities of pallet type / boxes

Weights and dimensions: indicate gross and net weight separately (may also be indicated on the

packing list)

Country of origin / origin of goods

INCOTERM

Contact details of any customs agent used

The checklist above can also be downloaded here so you can print it out and tick it off again with each shipment. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we will not be able to ship your shipment to the UK. Your shipment will then be delayed.

Contact

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@be.mainfreight.com.

Brexit Update 14 December 2020

With only 3 weeks to go the Brexit is now really getting closer. Deal or no-deal: from 1 January 2021 all shipments to and from the United Kingdom (UK) will become subject to customs and so the sender must provide the correct documents and customs data with each shipment.

As the impact on the transport sector is still unclear, the consequences for costs and transit times cannot yet be predicted. We are currently seeing a significant increase in volumes to and from the UK. We see these pre-Brexit volumes with our own customers and in the market. Waiting times within the various links of the logistics chain are increasing enormously, causing delays in delivery (1-2 days) for groupage shipments. The current expectation is that due to the enormous volumes from 22 December onwards, we will no longer be able to guarantee regular departures with an arrival before 1 January. For bookings from 22 December onwards, we kindly ask you to provide these bookings (digitally) with a packing list and invoice because these shipments may already be subject to customs duties. As of today, LTL and FTL shipments (> 2 loading meters) are fully on demand because we can no longer guarantee the capacity for these larger shipments. We will keep you informed via SCEU/Mainchain. You can also contact our UK department if you have any questions (uk@be.mainfreight.com).

Have your invoice and packing list checked before January 1st

We would like to offer you as a service to share your invoice and packing list already with brexit@be.mainfreight.com. We will then check for you whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To find out what information your invoice and packing list should contain, please refer to sheet 15 of the enclosed Brexit presentation. If any of your information is missing, or your goods description is incorrect, or your documents reach us after 16.00 hours, we will not be able to ship your shipment to the UK after 1 January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

Ireland & Northern Ireland

We get a lot of questions regarding our transit times and routes to (Northern) Ireland. At the moment we supply the entire island of Ireland via Dublin. We leave with both trailers and containers to Ireland and this way we keep all options open for ourselves. If it appears that a certain route is no longer optimal due to Brexit congestion, we will immediately take action and inform you.

Packing wood for import and export after Brexit

Do not take any risk in your trade with the United Kingdom. Use only packaging wood (such as pallets, wooden crates, boxes, cable reel and dunnage to secure the load) that has been treated against pests and marked according to the international standard ISPM 15. This standard becomes mandatory after Brexit.

Offer your receiver in the UK a helping hand

It is possible that your customer in the UK will ask you for help with the preparations for the Brexit. For customs clearance in the UK your customer can use our partner Davies Turner. Davies Turner will take care of customs clearance in the UK for your customer . If your customer would like to use this service, please let us know at brexit@be.mainfreight.com and we will make sure Davies Turner contacts your customer. Please mention the name and email address of your contact person in the mail.

Contact

For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this.

We have completely updated our Brexit pages with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs department at brexit@be.mainfreight.com.

As the impact on the transport sector is still unclear, the consequences for costs and transit times cannot yet be predicted. We are currently seeing a significant increase in volumes to and from the UK. We see these pre-Brexit volumes with our own customers and in the market. Waiting times within the various links of the logistics chain are increasing enormously, causing delays in delivery (1-2 days) for groupage shipments. The current expectation is that due to the enormous volumes from 22 December onwards, we will no longer be able to guarantee regular departures with an arrival before 1 January. For bookings from 22 December onwards, we kindly ask you to provide these bookings (digitally) with a packing list and invoice because these shipments may already be subject to customs duties. As of today, LTL and FTL shipments (> 2 loading meters) are fully on demand because we can no longer guarantee the capacity for these larger shipments. We will keep you informed via SCEU/Mainchain. You can also contact our UK department if you have any questions (uk@be.mainfreight.com).

Have your invoice and packing list checked before January 1st

We would like to offer you as a service to share your invoice and packing list already with brexit@be.mainfreight.com. We will then check for you whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To find out what information your invoice and packing list should contain, please refer to sheet 15 of the enclosed Brexit presentation. If any of your information is missing, or your goods description is incorrect, or your documents reach us after 16.00 hours, we will not be able to ship your shipment to the UK after 1 January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

Ireland & Northern Ireland

We get a lot of questions regarding our transit times and routes to (Northern) Ireland. At the moment we supply the entire island of Ireland via Dublin. We leave with both trailers and containers to Ireland and this way we keep all options open for ourselves. If it appears that a certain route is no longer optimal due to Brexit congestion, we will immediately take action and inform you.

Packing wood for import and export after Brexit

Do not take any risk in your trade with the United Kingdom. Use only packaging wood (such as pallets, wooden crates, boxes, cable reel and dunnage to secure the load) that has been treated against pests and marked according to the international standard ISPM 15. This standard becomes mandatory after Brexit.

Offer your receiver in the UK a helping hand

It is possible that your customer in the UK will ask you for help with the preparations for the Brexit. For customs clearance in the UK your customer can use our partner Davies Turner. Davies Turner will take care of customs clearance in the UK for your customer . If your customer would like to use this service, please let us know at brexit@be.mainfreight.com and we will make sure Davies Turner contacts your customer. Please mention the name and email address of your contact person in the mail.

Contact

For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this.

We have completely updated our Brexit pages with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs department at brexit@be.mainfreight.com.

Brexit Update 4 December 2020

In our previous updates we informed you about the Incoterms we will apply for import/export shipments from/to the UK, as well as the benefits of having Mainfreight handle your customs clearance, our rates concerning customs formalities, the possibility of direct representation and much more.

Preparation time is never wasted time

As Brexit is approaching, we emphasize the importance of a good preparation. In the first place a good preparation from our side and that means helping our partners prepare and organize themselves for the Brexit.

We offer a comprehensive presentation containing the main elements you should focus on when exporting to the UK after the Brexit.

These elements are:

- Our lead-times and services, including how Brexit will possibly impact these

- How to book your shipment orders

- Making sure you have an EORI-number

- To look up what HS-code applies to your goods flow

- To decide on your preferred Incoterms

- Our rates for customs-related services

- Required documents for each shipment

Have your invoice and packing list checked before January 1st

We offer a service to share your invoice and packing list with brexit@be.mainfreight.com. We will check whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To know what information your invoice and packing list should contain, please see sheet 16 in our above Brexit presentation. If any of your details are missing, or your goods description is not correct, or your documents reach us after 16.00 hours, we will not be able to ship your shipment on time to the UK after the 1st January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

Current waiting times in Calais

Due to heavy pre-Brexit traffic at this moment, Mainfreight experiences long waiting times to cross the channel.

We thank you for your understanding and we do everything we can to minimize lead-times.

Direct representation

Last but not least, we would like to point you about the direct representation Mainfreight needs in case you decide to assign us your customs formalities.

Do you have any further questions regarding Brexit? Please contact your accountmanager or our Brexit team: brexit@be.mainfreight.com.

Preparation time is never wasted time

As Brexit is approaching, we emphasize the importance of a good preparation. In the first place a good preparation from our side and that means helping our partners prepare and organize themselves for the Brexit.

We offer a comprehensive presentation containing the main elements you should focus on when exporting to the UK after the Brexit.

These elements are:

- Our lead-times and services, including how Brexit will possibly impact these

- How to book your shipment orders

- Making sure you have an EORI-number

- To look up what HS-code applies to your goods flow

- To decide on your preferred Incoterms

- Our rates for customs-related services

- Required documents for each shipment

Have your invoice and packing list checked before January 1st

We offer a service to share your invoice and packing list with brexit@be.mainfreight.com. We will check whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To know what information your invoice and packing list should contain, please see sheet 16 in our above Brexit presentation. If any of your details are missing, or your goods description is not correct, or your documents reach us after 16.00 hours, we will not be able to ship your shipment on time to the UK after the 1st January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

Current waiting times in Calais

Due to heavy pre-Brexit traffic at this moment, Mainfreight experiences long waiting times to cross the channel.

We thank you for your understanding and we do everything we can to minimize lead-times.

Direct representation

Last but not least, we would like to point you about the direct representation Mainfreight needs in case you decide to assign us your customs formalities.

Do you have any further questions regarding Brexit? Please contact your accountmanager or our Brexit team: brexit@be.mainfreight.com.

Brexit Update 16 November

Latest Brexit News

In the light of Brexit that is approaching shortly, we would like to update you with the following information. We do this so that you are well informed what to do after the Brexit, as well as to finalize our own preparation here at Mainfreight.

Advantages of Mainfreight handling your customs formalities

When exporting goods to the UK after the first of January 2021, customs formalities will be required.

With our specialized know-how we are capable to offer solutions to all your customs-related needs that go along with your logistics flow. Mainfreight is AEO-certified which means that shipments subject to customs formalities will know a smooth and efficient handling with us. All you need to do is send us the invoice and packing list – digital of course – and Mainfreight can handle all customs formalities for you.

| Activity | Fee |

| Creation of export declaration EX A/EX EU | € 50,00 |

| For extra customs articles(HS-code) | € 8,00 |

| Creation of individual transit document | € 45,00 |

| For extra articles in T-document | € 8,00 |

| Creation of import document IM A/H | € 70,00 |

| Commission on advances | 3,00% |

Partner in the UK

For network shipments (1-5 pallets), Mainfreight advises you and your consignee to engage with our partner Davies Turner to handle import documents. Our daily shuttles from and to Davies Turner will be supported by a consolidated Transit document which means import declarations do not have to be made at the point of entry in the UK but only when the shipments are at our partner’s depot in Dartford. This way, we expect to circumvent any delays at the border.

Davies Turner relies on an in-house customs department which means your shipment can be delivered without any trouble. The advantage of engaging in a combination of working with Mainfreight – Davies Turner means that we already prepare the necessary documents by sharing data before the shuttle arrives.

Your client/consignee in the UK can already contact Davies Turner in order to take care of customs import formalities (road@daviesturner.co.uk) and with Mainfreight London for direct and full trailer loads (sales@uk.mainfreight.com).

Direct representation

If you decide to choose Mainfreight as your partner for the creation of your customs formalities, we ask you to carefully read the attached document ‘DV ENG’, fill it out, and send it back to your accountmanager (signed).

You will notice this document asks for an EORI-number. Such number is mandatory for exporting/importing to/from the UK as per January 1st. We strongly advise you to verify of you have this registration already in place, and if not to apply with the proper authorities.

If you would choose to let a third party take care of your customs formalities, a small fee will be applicable due to the fact that that Mainfreight still needs to process these forms along with your shipment, as well as to include your shipment on the consolidated transit document.

The precise amounts of these fees will be communicated with you in a next news letter.

Incoterms

In our previous communication we informed you briefly on the Incoterms that Mainfreight will apply for

shipments to and from the UK.

We will apply three Incoterms: DAP (Delivered At Place), DDP (Delivery Duties Paid) and EXW (Ex Works).

Each of these has a different impact on the flow of customs formalities and the responsibility. We would like to refer to the schedule which is added under this paragraph. For a more detailed explanation, don’t hesitate to contact your account manager.

After a query with our customers, we conclude that most shipments will be handled in a DAP set-up. This is also the Incoterm that Mainfreight advises to all its customers: the seller takes care of the export declaration and the seller is responsible for any export licence or extra declarations, if necessary.

For import in the country of destination the buyer takes care of the import declaration and pays any import duties when applicable. Also, does the buyer apply for extra import documents or an import licence if necessary.

Correct and complete data

Starting January 1st, it will be of the utmost importance that you shipment contains all the necessary (and correct) data. This in order to be able to swiftly create the necessary customs formalities and process your shipment. Together we can minimize the risk of your shipment getting blocked somewhere along the supply chain. A good exercise is to already check under which HS-code (Harmonized System) your shipments can fall. Please be advised that there will be multiple HS-codes if your shipment does not consist of a single, homogenous good.

Business as usual

As for now, you can continue to ship to and from the UK as you are used to. When more information regarding the Brexit and the precise interpretation of the consequences becomes available, we will inform you of course.Our Brexit website (https://www.mainfreight.com/nl-be/brexit-update-belgium) is fully updated with the latest information.

Do you have any further questions regarding Brexit? Please contact your accountmanager or our Brexit department: brexit@be.mainfreight.com.

More Information?

Get in touch with our special Brexit team

Contact us