Brexit

Visit our Brexit page here and read the latest updates

Brexit Updates

Find the latest Brexit news and updates

Brexit 31st August 2022

The UK customs authority HMRC is closing its Customs Handling of Import and Export Freight (CHIEF) system on March 31, 2023. It will be replaced by a more modern and secure IT platform, the Customs Declaration Service (CDS). This will be the UK’s only customs platform. All companies making customs declarations in the UK will have to declare goods using this Customs Declaration Service. They will need to prepare for this in good time otherwise cargo in the UK may soon be delayed.

HMRC is implementing the replacement of the system in two phases:

- From 30 September 2022, it will no longer be possible to make import declarations using CHIEF

- From 31 March 2023, export declarations can also no longer be made using CHIEF

The UK government has already informed all registered UK importers about this. However, our partner in the UK, Davies Turner, has noticed that not all importers are currently aware of this upcoming change. Therefore, if your customer is not prepared in time, your goods will not be able to be cleared and there will (possibly) be storage costs.

Our partner Davies Turner is now also actively approaching the importers known to them (via email and telephone, when handling current import shipments) to ensure that we can still offer you smooth import handling after September 30. However, the responsibility for being properly prepared lies with the importer.

You may be able to help by contacting your customer in the UK and asking them if they are properly prepared to use the new system.

Some useful link(s):

Customs Declaration Service (CDS) - Action required | Davies Turner

Trader checklist – moving to Customs Declaration Service | GOV.UK

HMRC is implementing the replacement of the system in two phases:

- From 30 September 2022, it will no longer be possible to make import declarations using CHIEF

- From 31 March 2023, export declarations can also no longer be made using CHIEF

The UK government has already informed all registered UK importers about this. However, our partner in the UK, Davies Turner, has noticed that not all importers are currently aware of this upcoming change. Therefore, if your customer is not prepared in time, your goods will not be able to be cleared and there will (possibly) be storage costs.

Our partner Davies Turner is now also actively approaching the importers known to them (via email and telephone, when handling current import shipments) to ensure that we can still offer you smooth import handling after September 30. However, the responsibility for being properly prepared lies with the importer.

You may be able to help by contacting your customer in the UK and asking them if they are properly prepared to use the new system.

Some useful link(s):

Customs Declaration Service (CDS) - Action required | Davies Turner

Trader checklist – moving to Customs Declaration Service | GOV.UK

Brexit 19 may 2022

Adjustment to demonstrating preferential origin for export to the United Kingdom

From 8 February it is no longer allowed to state the country code 'EU' on the origin declaration. A specific country code should be used instead.

If your invoice contains several statistical numbers from various European countries, we recommend that you enter NL as the country code. The Netherlands is the country from which your goods are transported to the UK (so-called 'Country of dispatch').

For more information, please refer this UK government website

From 8 February it is no longer allowed to state the country code 'EU' on the origin declaration. A specific country code should be used instead.

If your invoice contains several statistical numbers from various European countries, we recommend that you enter NL as the country code. The Netherlands is the country from which your goods are transported to the UK (so-called 'Country of dispatch').

For more information, please refer this UK government website

Brexit Update 14 December 2021

We would like to inform you to a number of new measures that will be implemented as of January 1, 2022 for transport to and from the United Kingdom:

No more delayed customs declaration

On January 1, 2022, Brexit will be one year away. For businesses, this means, among other things, an end to delayed customs declarations for imports into the UK and the introduction of full customs declarations and checks. From this date, a fully completed UK import declaration is mandatory. When goods arrive they must be cleared immediately, post-clearance clearance is no longer possible. If customs clearance is not arranged in a timely manner, there is a possibility of delays and additional costs.

Adjustment on proof of preferential origin for exports to the United Kingdom

With the introduction of Brexit, a new trade agreement between the European Union and the United Kingdom also entered into force. In the trade agreement between the two, favorable (reduced or zero) import duties have been agreed upon to promote trade. To qualify for treatment under these favorable import rules, a company must prove the origin of goods.

In 2021, it was possible in the UK to claim preferential origin by displaying a country name or country code on commercial papers (invoice). This meant that the UK importer did not have to pay import duties on these goods. Whereas a declaration of origin is already required for imports from the UK to avoid paying import duties, this was not yet required for exports to the UK due to relaxed application of the rules in the UK. This relaxation was applied in order not to further disrupt trade between the European Union and United Kingdom. On January 1, 2022, this situation changes.

All goods arriving in the UK on or after 1 January 2022 must have a specific declaration, preferably displayed on the invoice, to qualify for preferential treatment. This declaration may also be displayed on the packing list or on a paper with a company logo, in which case it must contain a specific and explicit reference to the relevant invoice to which it relates.

In summary, if this declaration does not appear on the papers or does not appear correctly, (if any) import duties will be charged.

The statement should state:

The exporter of the products covered by this document (Exporters REX No ...(1)) declares that,

except where otherwise clearly indicated, these products are of ...(2) preferential origin.

…………………………………………………………….............................................(3)

(Place and date)

…………………………………………………………….............................................

(Name of the exporter)

Foot notes

1. Indicate the reference number by which the exporter is identified. For the European Union exporter, this number will be assigned in accordance with the laws and regulations of the Union, ie a Registered Exporter number (REX number). Where the exporter has not been assigned a number, this field may be left blank if the cargo value is less than €6.000

2. Indicate the origin of the product: the European Union, or United Kingdom.

3. Place and date may be omitted if the information is contained on the document itself.

When exporting from the EU to the UK, the above statement of origin can be made by any exporter if the invoice has a value of €6,000 (approximately £5,700) or less. Above this amount, the EU exporter must actually have a Registered Exporter (REX) number and include it in this declaration. Otherwise, the declaration is not valid and the shipment is not eligible for preferential customs clearance.

A Dutch exporter can register as a REX by using the application form published on the Customs website.

Duty to pre-notify agricultural and food products

As of January 1, 2022, all agricultural and food products (both animal and plant products) must be pre-notified in the UK IPAFFS system by the importer. It is therefore important that, if it concerns a shipment with these products, you as the exporting party coordinate this with the UK importer and that you inform us if it concerns this type of shipments goes by emailing uk@nl.mainfreight.com.

As of July 1, 2022, a certification requirement will apply and you will have to deal with new import requirements from UK Customs. For more information, please visit the following link:

https://www.rvo.nl/onderwerpen/internationaal-ondernemen/landenoverzicht/verenigd-koninkrijk/producteisen-1-januari-2021/exporteren-naar-het-vk-certificeringen

Contact

We have completely updated our Brexit website with the latest information. Here you will also find our Brexit presentation that answers the most frequently asked questions. Do you still have questions or do you need help regarding the Brexit? Please contact your account manager or our customs department at brexit@nl.mainfreight.com.

No more delayed customs declaration

On January 1, 2022, Brexit will be one year away. For businesses, this means, among other things, an end to delayed customs declarations for imports into the UK and the introduction of full customs declarations and checks. From this date, a fully completed UK import declaration is mandatory. When goods arrive they must be cleared immediately, post-clearance clearance is no longer possible. If customs clearance is not arranged in a timely manner, there is a possibility of delays and additional costs.

Adjustment on proof of preferential origin for exports to the United Kingdom

With the introduction of Brexit, a new trade agreement between the European Union and the United Kingdom also entered into force. In the trade agreement between the two, favorable (reduced or zero) import duties have been agreed upon to promote trade. To qualify for treatment under these favorable import rules, a company must prove the origin of goods.

In 2021, it was possible in the UK to claim preferential origin by displaying a country name or country code on commercial papers (invoice). This meant that the UK importer did not have to pay import duties on these goods. Whereas a declaration of origin is already required for imports from the UK to avoid paying import duties, this was not yet required for exports to the UK due to relaxed application of the rules in the UK. This relaxation was applied in order not to further disrupt trade between the European Union and United Kingdom. On January 1, 2022, this situation changes.

All goods arriving in the UK on or after 1 January 2022 must have a specific declaration, preferably displayed on the invoice, to qualify for preferential treatment. This declaration may also be displayed on the packing list or on a paper with a company logo, in which case it must contain a specific and explicit reference to the relevant invoice to which it relates.

In summary, if this declaration does not appear on the papers or does not appear correctly, (if any) import duties will be charged.

The statement should state:

The exporter of the products covered by this document (Exporters REX No ...(1)) declares that,

except where otherwise clearly indicated, these products are of ...(2) preferential origin.

…………………………………………………………….............................................(3)

(Place and date)

…………………………………………………………….............................................

(Name of the exporter)

Foot notes

1. Indicate the reference number by which the exporter is identified. For the European Union exporter, this number will be assigned in accordance with the laws and regulations of the Union, ie a Registered Exporter number (REX number). Where the exporter has not been assigned a number, this field may be left blank if the cargo value is less than €6.000

2. Indicate the origin of the product: the European Union, or United Kingdom.

3. Place and date may be omitted if the information is contained on the document itself.

When exporting from the EU to the UK, the above statement of origin can be made by any exporter if the invoice has a value of €6,000 (approximately £5,700) or less. Above this amount, the EU exporter must actually have a Registered Exporter (REX) number and include it in this declaration. Otherwise, the declaration is not valid and the shipment is not eligible for preferential customs clearance.

A Dutch exporter can register as a REX by using the application form published on the Customs website.

Duty to pre-notify agricultural and food products

As of January 1, 2022, all agricultural and food products (both animal and plant products) must be pre-notified in the UK IPAFFS system by the importer. It is therefore important that, if it concerns a shipment with these products, you as the exporting party coordinate this with the UK importer and that you inform us if it concerns this type of shipments goes by emailing uk@nl.mainfreight.com.

As of July 1, 2022, a certification requirement will apply and you will have to deal with new import requirements from UK Customs. For more information, please visit the following link:

https://www.rvo.nl/onderwerpen/internationaal-ondernemen/landenoverzicht/verenigd-koninkrijk/producteisen-1-januari-2021/exporteren-naar-het-vk-certificeringen

Contact

We have completely updated our Brexit website with the latest information. Here you will also find our Brexit presentation that answers the most frequently asked questions. Do you still have questions or do you need help regarding the Brexit? Please contact your account manager or our customs department at brexit@nl.mainfreight.com.

Brexit Update 10 February 2021

After several weeks of Brexit transport to and from the United Kingdom (UK), we at Mainfreight are trying to optimize the process even further. Unfortunately, the clearance process on the UK side is still causing delays in the delivery process. We anticipate this by driving to several depots, spread throughout the UK, in order to limit the delays.

We also see that recipients/importers in the UK do not always cooperate immediately. We then do not receive the correct information to take care of customs clearance. To help our colleagues in the UK and to speed up the process, we would like to ask you to have your consignee/importer of the shipment sign this Letter of Empowerment in advance. You can mail the signed Letter of Empowerment to uk@nl.mainfreight.com.

Finally, before you book the shipment with us and submit the data to us, check that your invoice and packing list meet all the requirements and that the data in the digital shipment is the same as the data on the invoice/packing list so that we can further take care of declaring your goods. To know what information must be on your invoice and packing list, you can download the completed checklist here.

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

We also see that recipients/importers in the UK do not always cooperate immediately. We then do not receive the correct information to take care of customs clearance. To help our colleagues in the UK and to speed up the process, we would like to ask you to have your consignee/importer of the shipment sign this Letter of Empowerment in advance. You can mail the signed Letter of Empowerment to uk@nl.mainfreight.com.

Finally, before you book the shipment with us and submit the data to us, check that your invoice and packing list meet all the requirements and that the data in the digital shipment is the same as the data on the invoice/packing list so that we can further take care of declaring your goods. To know what information must be on your invoice and packing list, you can download the completed checklist here.

Contact

We have completely updated our Brexit website with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Brexit Update 26 January 2021

After 3 weeks of Brexit transport to and from the United Kingdom (UK), we at Mainfreight are trying to optimize the process even further. For example, we see that if the importer's contact details are clearly stated in the shipment or on the invoice, the handling of the shipment on the UK side runs many times smoother. We therefore make an urgent request that, in addition to the importer's contact details which are already mandatory, the importer's email address and telephone number are clearly stated in the shipment (or on the invoice).

In addition, as a customer you can speed up the process in the UK even more by providing us with the 10-digit HS code instead of the 8-digit HS code. The Chamber of Commerce writes the following about this:

"Each country individually can extend the HS code of a product. Within the EU we have 8-digit codes for goods that you export from the EU (HS codes supplemented with 2 digits). When importing goods into the EU, you need 10-digit codes (HS codes supplemented with 4 digits). These codes are also called commodity codes."

So for an export, an 8-digit HS code is sufficient, but for an import, a 10-digit HS code must be supplied.

Finally, before you book the shipment with us and submit the data to us, check that your invoice and packing list meet all the requirements and that the data in the digital shipment is the same as the data on the invoice/packing list so that we can further take care of declaring your goods. To know what information must be on your invoice and packing list, please download here the completed checklist.

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

In addition, as a customer you can speed up the process in the UK even more by providing us with the 10-digit HS code instead of the 8-digit HS code. The Chamber of Commerce writes the following about this:

"Each country individually can extend the HS code of a product. Within the EU we have 8-digit codes for goods that you export from the EU (HS codes supplemented with 2 digits). When importing goods into the EU, you need 10-digit codes (HS codes supplemented with 4 digits). These codes are also called commodity codes."

So for an export, an 8-digit HS code is sufficient, but for an import, a 10-digit HS code must be supplied.

Finally, before you book the shipment with us and submit the data to us, check that your invoice and packing list meet all the requirements and that the data in the digital shipment is the same as the data on the invoice/packing list so that we can further take care of declaring your goods. To know what information must be on your invoice and packing list, please download here the completed checklist.

Contact

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Brexit Update 19 January 2021

As you may have heard in the news last week, a number of carriers are currently no longer driving to the United Kingdom (UK). We as Mainfreight have decided to still offer daily transport to and from the UK. However, we do ask you as our customer to help us as much as possible for a smooth flow.

Mainfreight has gone through the first Brexit weeks. Unfortunately, we have noticed that not all customers are equally well prepared for the Brexit and this is creating increasing challenges for us. Because the documentation is often incomplete or because data in the digital shipment does not match the data on the invoice/packing note, our crossdock is full of shipments that cannot be shipped to the UK and our employees are very busy collecting the correct documentation to be able to send the shipments.

Due to the strict lockdown in the UK, many people are working at home and it is very difficult for our partner to handle the imports. Therefore we urge you to share the contact person, phone number, email address and GB Eori number of the importer in the UK. Partly by doing this we speed up the handling in the UK. Should the importer arrange customs clearance himself with another party, please also let us know clearly and share the contact details of this with us.

Before you book the shipment with us and provide us with the data, please check whether your invoice and packing list meet all the requirements and whether the data in the digital shipment is the same as the data on the invoice/packing list so that we can continue to declare your goods.

In order to know what information should be on your invoice and packing list, we have made a checklist below so you can check if everything is on your invoice:

Data shipper/exporter

Type & numbers / quantities of pallet type / boxes

Weights and dimensions: indicate gross and net weight separately (may also be indicated on the

packing list)

Country of origin / origin of goods

INCOTERM

Contact details of any customs agent used

The checklist above can also be downloaded here so you can print it out and tick it off again with each shipment. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we will not be able to ship your shipment to the UK. Your shipment will then be delayed.

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Mainfreight has gone through the first Brexit weeks. Unfortunately, we have noticed that not all customers are equally well prepared for the Brexit and this is creating increasing challenges for us. Because the documentation is often incomplete or because data in the digital shipment does not match the data on the invoice/packing note, our crossdock is full of shipments that cannot be shipped to the UK and our employees are very busy collecting the correct documentation to be able to send the shipments.

Due to the strict lockdown in the UK, many people are working at home and it is very difficult for our partner to handle the imports. Therefore we urge you to share the contact person, phone number, email address and GB Eori number of the importer in the UK. Partly by doing this we speed up the handling in the UK. Should the importer arrange customs clearance himself with another party, please also let us know clearly and share the contact details of this with us.

Before you book the shipment with us and provide us with the data, please check whether your invoice and packing list meet all the requirements and whether the data in the digital shipment is the same as the data on the invoice/packing list so that we can continue to declare your goods.

In order to know what information should be on your invoice and packing list, we have made a checklist below so you can check if everything is on your invoice:

Data shipper/exporter

- Name, address, place of residence

- EORI number

- VAT number

- Name, address, place of residence

- EORI number

- VAT number

- preferably specific, not generic (e.g. only the description "spare parts" is not specific enough)

- amount & corresponding currency

Type & numbers / quantities of pallet type / boxes

Weights and dimensions: indicate gross and net weight separately (may also be indicated on the

packing list)

Country of origin / origin of goods

INCOTERM

Contact details of any customs agent used

The checklist above can also be downloaded here so you can print it out and tick it off again with each shipment. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we will not be able to ship your shipment to the UK. Your shipment will then be delayed.

Contact

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Brexit Update 12 January 2021

Since 1 January, the United Kingdom (UK) has officially become, by leaving the European Union, a customs country. This means that customs formalities apply to the movement of goods with the UK and so every shipper must provide the required documentation with each UK consignment.

Mainfreight has had its first Brexit week. Unfortunately we notice that not all customers are equally well prepared for the Brexit and this presents us with major challenges. Because the documentation is often not complete, our crossdock is full of shipments that cannot be shipped to the UK and our employees are very busy collecting the right documentation to still be able to send the shipments.

We therefore make an urgent appeal to you as our customer. Before you book the shipment with us and deliver the data to us, please check that your invoice and packing list meet all the requirements to take care of the declaration of your goods. In order to know what information should be on your invoice and packing list, we have made a checklist below so you can check if everything is on your invoice:

Data shipper/exporter

INCOTERM

The checklist above can also be downloaded here so you can print it out and tick it off again with each shipment. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we will not be able to ship your shipment to the UK. Your shipment will then be delayed.

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the enclosed Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Mainfreight has had its first Brexit week. Unfortunately we notice that not all customers are equally well prepared for the Brexit and this presents us with major challenges. Because the documentation is often not complete, our crossdock is full of shipments that cannot be shipped to the UK and our employees are very busy collecting the right documentation to still be able to send the shipments.

We therefore make an urgent appeal to you as our customer. Before you book the shipment with us and deliver the data to us, please check that your invoice and packing list meet all the requirements to take care of the declaration of your goods. In order to know what information should be on your invoice and packing list, we have made a checklist below so you can check if everything is on your invoice:

Data shipper/exporter

- Name, address, place of residence

- EORI number

- VAT number

- Name, address, place of residence

- EORI number

- VAT number

- preferably specific, not generic (e.g. only the description "spare parts" is not specific enough)

- amount & corresponding currency

- Type & numbers / quantities of pallet type / boxes

- Weights and dimensions: indicate gross and net weight separately (may also be indicated on the packing list)

INCOTERM

The checklist above can also be downloaded here so you can print it out and tick it off again with each shipment. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we will not be able to ship your shipment to the UK. Your shipment will then be delayed.

Contact

We as Mainfreight are ready for it and will face the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. We have completely updated our Brexit website with the latest information. Here you will also find the enclosed Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Brexit Update 5 January 2021

Since last Friday the Brexit is finally a fact. Just before Christmas, a Brexit deal was closed. Negotiators from the European Union and the United Kingdom (UK) have reached an agreement about their future trade relationship. However, the deal does not mean that shipments to and from the UK are not subject to customs duty, because despite the agreement, customs formalities now apply for every shipment to and from the UK and so you, as the shipper, must provide the required documentation with each UK shipment.

We, as Mainfreight, are ready for this and look forward to the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. At the moment the expected traffic at the border is still not there but this can change quickly due to an increase in freight traffic to the UK. Therefore, we cannot yet predict what the coming weeks will look like.

By means of these Brexit newsletters we as Mainfreight have tried to inform you as well as possible in advance about the Brexit and what preparations were expected of you as a customer. Unfortunately, we notice that not all customers are equally well prepared. Please check, before you deliver the data to us, if your invoice and packing list meet all the requirements to take care of the declaration of your goods. To know exactly what information your invoice and packing list should contain, please refer to sheet 15 of the Brexit manual. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we cannot ship your shipment to the UK. Your shipment will be delayed.

Contact

We have completely updated our Brexit website with the latest information. Here you will also find the enclosed Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

We, as Mainfreight, are ready for this and look forward to the coming period with great confidence. The first shipments have successfully arrived and been handled in the UK. At the moment the expected traffic at the border is still not there but this can change quickly due to an increase in freight traffic to the UK. Therefore, we cannot yet predict what the coming weeks will look like.

By means of these Brexit newsletters we as Mainfreight have tried to inform you as well as possible in advance about the Brexit and what preparations were expected of you as a customer. Unfortunately, we notice that not all customers are equally well prepared. Please check, before you deliver the data to us, if your invoice and packing list meet all the requirements to take care of the declaration of your goods. To know exactly what information your invoice and packing list should contain, please refer to sheet 15 of the Brexit manual. If any of your details are missing, if your goods description is not correct, or if your documents reach us after 16.00 hours then unfortunately we cannot ship your shipment to the UK. Your shipment will be delayed.

Contact

We have completely updated our Brexit website with the latest information. Here you will also find the enclosed Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content).

Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Brexit Update 10 December 2020

With only 3 weeks to go the Brexit is now really getting closer. Deal or no-deal: from 1 January 2021 all shipments to and from the United Kingdom (UK) will become subject to customs and so the sender must provide the correct documents and customs data with each shipment.

As the impact on the transport sector is still unclear, the consequences for costs and transit times cannot yet be predicted. We are currently seeing a significant increase in volumes to and from the UK. We see these pre-Brexit volumes with our own customers and in the market. Waiting times within the various links of the logistics chain are increasing enormously, causing delays in delivery (1-2 days) for groupage shipments. The current expectation is that due to the enormous volumes from 22 December onwards, we will no longer be able to guarantee regular departures with an arrival before 1 January. For bookings from 22 December onwards, we kindly ask you to provide these bookings (digitally) with a packing list and invoice because these shipments may already be subject to customs duties. As of today, LTL and FTL shipments (> 2 loading meters) are fully on demand because we can no longer guarantee the capacity for these larger shipments. We will keep you informed via SCEU/Mainchain. You can also contact our UK department if you have any questions (uk@nl.mainfreight.com).

Current situation transport United Kingdom -

Current situation transport United Kingdom - Update 22 December 2020

After yesterday's depressed news, following the mutated coronavirus in the United Kingdom (UK), the situation is unfortunately still unchanged. Mainfreight Transport is still looking for ways to get your shipments to the UK but capacity is still limited. In order to be of the best possible service to you as a customer Mainfreight Air will work with our offices at Schiphol and London to transport shipments to and from the UK by air. If you are interested in this solution you can contact our office in Amsterdam who will help you further: ams.sales@nl.mainfreight.com.

For the latest developments we would like to refer you to the website of ‘Transport en Logistiek Nederland’ (TLN): www.tln.nl/nieuws/liveblog-coronavirus/#continue. TLN shares through their live blog updates about the corona crisis and the consequences for the transport and logistics sector.

21 December 2020

Unfortunately, we have to inform you that transport to and from the United Kingdom (UK) has become even more difficult due to the developments last weekend. The new and possibly more contagious variant of the coronavirus, which is currently circulating in part of the UK, means that the country is almost completely cut off from the outside world. Passenger traffic by plane, ferry, train or through the tunnel is prohibited. The ban follows an advice from the authorities that travel movements from the UK should be restricted as much as possible. Freight transport - accompanied and unaccompanied - is still possible to and from the UK. However, the capacity is many times smaller than the demand from the market. Mainfreight looks for all possible solutions to get capacity to and from the UK but unfortunately this has a major impact on our transit times and deliveries. Mainfreight can therefore no longer offer any guarantee on transit times and that shipments will be delivered to or from the UK before January 1st.

New general terms and conditions

Our General Terms and Conditions have already been adapted to the new situation after January 1st. For the new surcharges for dutiable countries, we would like to refer you to Article 14 of the document on our website www.mainfreight.com/TermsAndConditionsNL-EN.

Have your invoice and packing list checked before January 1st

We would like to offer you as a service to share your invoice and packing list already with brexit@nl.mainfreight.com. We will then check for you whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To find out what information your invoice and packing list should contain, please refer to sheet 15 of the enclosed Brexit presentation. If any of your information is missing, or your goods description is incorrect, or your documents reach us after 16.00 hours, we will not be able to ship your shipment to the UK after 1 January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

Ireland & Northern Ireland

We get a lot of questions regarding our transit times and routes to (Northern) Ireland. At the moment we supply the entire island of Ireland via Dublin. We leave with both trailers and containers to Ireland and this way we keep all options open for ourselves. If it appears that a certain route is no longer optimal due to Brexit congestion, we will immediately take action and inform you.

Offer your receiver in the UK a helping hand

It is possible that your client in the UK will ask you for help with the preparations for the Brexit. For customs clearance in the UK your client can use our partner Davies Turner. Davies Turner will then take care of customs clearance in the UK for your client. If your client would like to use this service, please let us know at brexit@nl.mainfreight.com and we will make sure Davies Turner contacts your client. Please mention the name and email address of your contact person in the mail.

Contact

For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this.

We have completely updated our Brexit website (www.mainfreight.com/BrexitNL-EN) with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content). Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs department at brexit@nl.mainfreight.com.

As the impact on the transport sector is still unclear, the consequences for costs and transit times cannot yet be predicted. We are currently seeing a significant increase in volumes to and from the UK. We see these pre-Brexit volumes with our own customers and in the market. Waiting times within the various links of the logistics chain are increasing enormously, causing delays in delivery (1-2 days) for groupage shipments. The current expectation is that due to the enormous volumes from 22 December onwards, we will no longer be able to guarantee regular departures with an arrival before 1 January. For bookings from 22 December onwards, we kindly ask you to provide these bookings (digitally) with a packing list and invoice because these shipments may already be subject to customs duties. As of today, LTL and FTL shipments (> 2 loading meters) are fully on demand because we can no longer guarantee the capacity for these larger shipments. We will keep you informed via SCEU/Mainchain. You can also contact our UK department if you have any questions (uk@nl.mainfreight.com).

Current situation transport United Kingdom -

Current situation transport United Kingdom - Update 22 December 2020

After yesterday's depressed news, following the mutated coronavirus in the United Kingdom (UK), the situation is unfortunately still unchanged. Mainfreight Transport is still looking for ways to get your shipments to the UK but capacity is still limited. In order to be of the best possible service to you as a customer Mainfreight Air will work with our offices at Schiphol and London to transport shipments to and from the UK by air. If you are interested in this solution you can contact our office in Amsterdam who will help you further: ams.sales@nl.mainfreight.com.

For the latest developments we would like to refer you to the website of ‘Transport en Logistiek Nederland’ (TLN): www.tln.nl/nieuws/liveblog-coronavirus/#continue. TLN shares through their live blog updates about the corona crisis and the consequences for the transport and logistics sector.

21 December 2020

Unfortunately, we have to inform you that transport to and from the United Kingdom (UK) has become even more difficult due to the developments last weekend. The new and possibly more contagious variant of the coronavirus, which is currently circulating in part of the UK, means that the country is almost completely cut off from the outside world. Passenger traffic by plane, ferry, train or through the tunnel is prohibited. The ban follows an advice from the authorities that travel movements from the UK should be restricted as much as possible. Freight transport - accompanied and unaccompanied - is still possible to and from the UK. However, the capacity is many times smaller than the demand from the market. Mainfreight looks for all possible solutions to get capacity to and from the UK but unfortunately this has a major impact on our transit times and deliveries. Mainfreight can therefore no longer offer any guarantee on transit times and that shipments will be delivered to or from the UK before January 1st.

New general terms and conditions

Our General Terms and Conditions have already been adapted to the new situation after January 1st. For the new surcharges for dutiable countries, we would like to refer you to Article 14 of the document on our website www.mainfreight.com/TermsAndConditionsNL-EN.

Have your invoice and packing list checked before January 1st

We would like to offer you as a service to share your invoice and packing list already with brexit@nl.mainfreight.com. We will then check for you whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To find out what information your invoice and packing list should contain, please refer to sheet 15 of the enclosed Brexit presentation. If any of your information is missing, or your goods description is incorrect, or your documents reach us after 16.00 hours, we will not be able to ship your shipment to the UK after 1 January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

Ireland & Northern Ireland

We get a lot of questions regarding our transit times and routes to (Northern) Ireland. At the moment we supply the entire island of Ireland via Dublin. We leave with both trailers and containers to Ireland and this way we keep all options open for ourselves. If it appears that a certain route is no longer optimal due to Brexit congestion, we will immediately take action and inform you.

Offer your receiver in the UK a helping hand

It is possible that your client in the UK will ask you for help with the preparations for the Brexit. For customs clearance in the UK your client can use our partner Davies Turner. Davies Turner will then take care of customs clearance in the UK for your client. If your client would like to use this service, please let us know at brexit@nl.mainfreight.com and we will make sure Davies Turner contacts your client. Please mention the name and email address of your contact person in the mail.

Contact

For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this.

We have completely updated our Brexit website (www.mainfreight.com/BrexitNL-EN) with the latest information. Here you will also find the Brexit presentation that answers the most frequently asked questions. In addition, you can find more information about transport to customs countries on the website of the European Commission (trade.ec.europa.eu/access-to-markets/en/content). Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs department at brexit@nl.mainfreight.com.

Brexit Update 19 November 2020

The United Kingdom (UK) - England, Scotland, Wales and Northern Ireland - has not been an EU Member since 31 January 2020. A transitional period applies until 1 January 2021. During this transitional period, all EU rules and laws still apply to the UK. For citizens and businesses almost nothing will change during this period. From 1 January 2021, all shipments to and from the UK will become subject to customs duty. Shippers must provide the correct documents and customs data with each shipment.

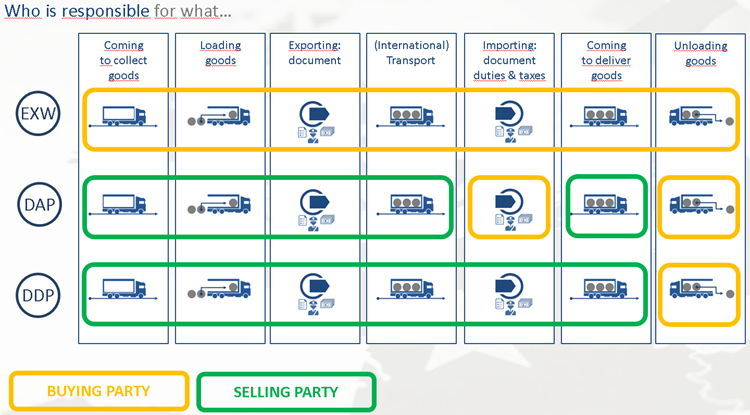

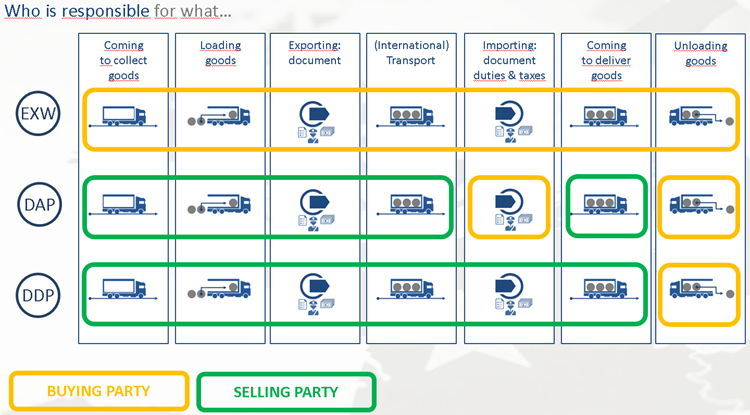

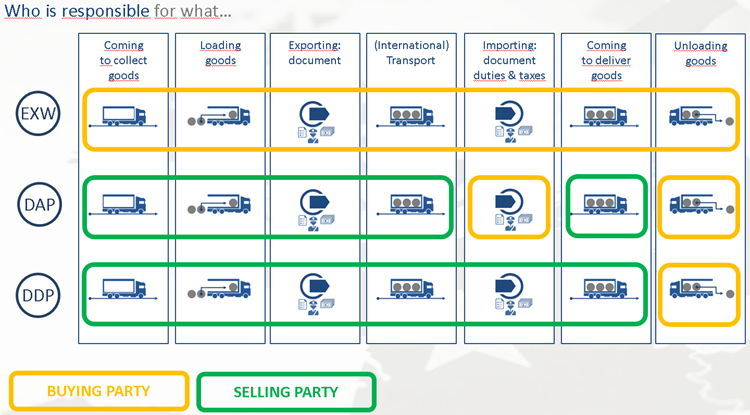

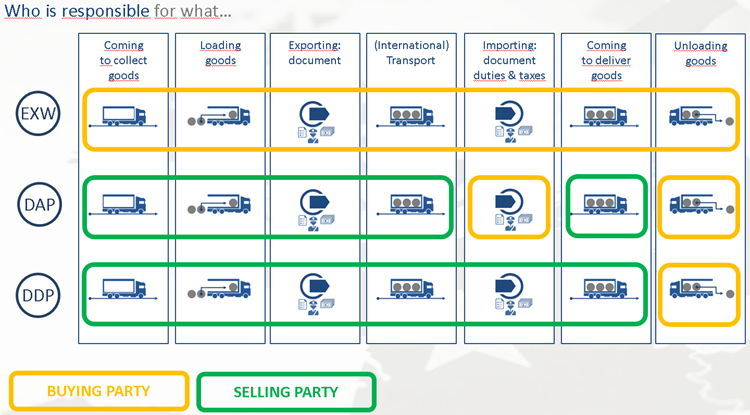

In our previous mailing we gave you more information about the Incoterms Mainfreight will initially support (EXW, DAP, DDP). After a tour of our major customers it appears that the majority will use the Incoterm DAP. This is also the Incoterm that we as Mainfreight recommend to our customers:

“The seller must arrange the export declaration with the customs. Furthermore, he is responsible for arranging an export license or other export documents, if necessary. For imports into the destination country, the buyer arranges the customs formalities and the payment of any import taxes. If necessary, the buyer also requests local import documents (e.g. an import permit).”

Benefits customs clearance by Mainfreight

Mainfreight is with its own customs department your reliable partner for customs clearance: reporting goods leaving the Netherlands or reporting goods entering the NL. With our specialist knowledge we are able to offer solutions for all your customs duties that match your logistic process. Mainfreight is AEO certified, allowing shipments subject to customs regulations to be handled quickly and efficiently. All you have to do is hand over your commercial invoice and packing list digitally and we take care of all customs formalities for you.

Mainfreight recommends that for your groupage shipments (1-5 pallets) you advise your consignee to use our partner Davies Turner to take care of the import into the UK. This with the reason that our daily shipping services will be provided with a transit document. This transit document ensures that the goods are cleared not at the border but at Davies Turner's customs depots in Dartford and Coleshill. In this way we ensure that we avoid the expected hustle and bustle at the border as much as possible. Davies Turner has in-house customs departments which ensure that your shipment can be delivered without delay. The advantage of working with the combination Davies Turner - Mainfreight is that we already share all documentation received from you with Davies Turner before the truck arrives at their customs depots. This ensures that the customs clearance process is completed as quickly as possible.

Your consignee in the UK can contact Davies Turner for the import of groupage shipments (road@daviesturner.co.uk) and for LTL/FTL shipments with Mainfreight London (sales@uk.mainfreight.com).

If you choose to have your customs issues handled by a 3rd party, there will be additional costs involved in Mainfreight providing information and clearing your (export) document on a collective transit document. We will share these extra costs with you in our next newsletter.

Direct representation and Power of Attorney of the Chamber of Commerce

If you would like Mainfreight to take care of your customs clearance please mail us your signed form Direct Representation in advance. If you would like Mainfreight to arrange your Certificate of Origin with the Chamber of Commerce, please provide us with the signed form Power of Attorney Chamber of Commerce. Both forms can be downloaded here

Packing wood for import and export after Brexit

Do not take any risk in your trade with the United Kingdom. Use only packaging wood (such as pallets, wooden crates, boxes, cable reel and dunnage to secure the load) that has been treated against pests and marked according to the international standard ISPM 15. This standard becomes mandatory after Brexit. The Packaging department of Mainfreight can help you with the purchase of these pallets (packaging@nl.mainfreight.com).

Volumes and capacity Q4 2020

We are currently seeing a significant increase in volumes to and from the United Kingdom. We see these pre-Brexit volumes with our own customers and in the market. Waiting times within the various links of the logistics chain are increasing, causing delays in delivery. We will keep you informed via SCEU/Mainchain. You can also contact our UK department (uk@nl.mainfreight.com).

Have your invoice and packing list checked before January 1st

We would like to offer you as a service to share your invoice and packing list with brexit@nl.mainfreight.com. We will then check for you whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To know what information your invoice and packing list should contain, please refer to our Brexit presentation (sheet 15) on our Brexit website. If any of your details are missing, or your goods description is not correct, or your documents reach us after 16.00 hours, we will not be able to ship your shipment to the UK after 1 January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

When you book a shipment to the UK via SCEU since this week, you will receive a notification that your goods are leaving the EU with a request to share your invoice and packing list with us. From 1 January it is possible to share your documents with us in this way.

Veterinary and phytosanitary products

When you have veterinary or phytosanitary products transported by us which, after the Brexit, need to be provided with extra documentation, we kindly ask you to contact us.

For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this.

We have completely updated our Brexit website with the latest information. Here you will also find a presentation that answers the most frequently asked questions and the form for 'Direct Representation'. Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs department at brexit@nl.mainfreight.com.

In our previous mailing we gave you more information about the Incoterms Mainfreight will initially support (EXW, DAP, DDP). After a tour of our major customers it appears that the majority will use the Incoterm DAP. This is also the Incoterm that we as Mainfreight recommend to our customers:

“The seller must arrange the export declaration with the customs. Furthermore, he is responsible for arranging an export license or other export documents, if necessary. For imports into the destination country, the buyer arranges the customs formalities and the payment of any import taxes. If necessary, the buyer also requests local import documents (e.g. an import permit).”

Benefits customs clearance by Mainfreight

Mainfreight is with its own customs department your reliable partner for customs clearance: reporting goods leaving the Netherlands or reporting goods entering the NL. With our specialist knowledge we are able to offer solutions for all your customs duties that match your logistic process. Mainfreight is AEO certified, allowing shipments subject to customs regulations to be handled quickly and efficiently. All you have to do is hand over your commercial invoice and packing list digitally and we take care of all customs formalities for you.

Mainfreight recommends that for your groupage shipments (1-5 pallets) you advise your consignee to use our partner Davies Turner to take care of the import into the UK. This with the reason that our daily shipping services will be provided with a transit document. This transit document ensures that the goods are cleared not at the border but at Davies Turner's customs depots in Dartford and Coleshill. In this way we ensure that we avoid the expected hustle and bustle at the border as much as possible. Davies Turner has in-house customs departments which ensure that your shipment can be delivered without delay. The advantage of working with the combination Davies Turner - Mainfreight is that we already share all documentation received from you with Davies Turner before the truck arrives at their customs depots. This ensures that the customs clearance process is completed as quickly as possible.

Your consignee in the UK can contact Davies Turner for the import of groupage shipments (road@daviesturner.co.uk) and for LTL/FTL shipments with Mainfreight London (sales@uk.mainfreight.com).

If you choose to have your customs issues handled by a 3rd party, there will be additional costs involved in Mainfreight providing information and clearing your (export) document on a collective transit document. We will share these extra costs with you in our next newsletter.

Direct representation and Power of Attorney of the Chamber of Commerce

If you would like Mainfreight to take care of your customs clearance please mail us your signed form Direct Representation in advance. If you would like Mainfreight to arrange your Certificate of Origin with the Chamber of Commerce, please provide us with the signed form Power of Attorney Chamber of Commerce. Both forms can be downloaded here

Packing wood for import and export after Brexit

Do not take any risk in your trade with the United Kingdom. Use only packaging wood (such as pallets, wooden crates, boxes, cable reel and dunnage to secure the load) that has been treated against pests and marked according to the international standard ISPM 15. This standard becomes mandatory after Brexit. The Packaging department of Mainfreight can help you with the purchase of these pallets (packaging@nl.mainfreight.com).

Volumes and capacity Q4 2020

We are currently seeing a significant increase in volumes to and from the United Kingdom. We see these pre-Brexit volumes with our own customers and in the market. Waiting times within the various links of the logistics chain are increasing, causing delays in delivery. We will keep you informed via SCEU/Mainchain. You can also contact our UK department (uk@nl.mainfreight.com).

Have your invoice and packing list checked before January 1st

We would like to offer you as a service to share your invoice and packing list with brexit@nl.mainfreight.com. We will then check for you whether your invoice and packing list meet all the requirements to take care of the declaration of your goods. To know what information your invoice and packing list should contain, please refer to our Brexit presentation (sheet 15) on our Brexit website. If any of your details are missing, or your goods description is not correct, or your documents reach us after 16.00 hours, we will not be able to ship your shipment to the UK after 1 January. Your shipment will then unfortunately be delayed. By using our control now you still have enough time to mention missing information on your invoice or packing list before January 1st. You will then be fully Brexit-ready!

When you book a shipment to the UK via SCEU since this week, you will receive a notification that your goods are leaving the EU with a request to share your invoice and packing list with us. From 1 January it is possible to share your documents with us in this way.

Veterinary and phytosanitary products

When you have veterinary or phytosanitary products transported by us which, after the Brexit, need to be provided with extra documentation, we kindly ask you to contact us.

Contact

For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this. We have completely updated our Brexit website with the latest information. Here you will also find a presentation that answers the most frequently asked questions and the form for 'Direct Representation'. Do you still have questions or would you like to talk further about the Brexit? Please contact your account manager or our customs department at brexit@nl.mainfreight.com.

Brexit Update 13 October 2020

The United Kingdom (UK) has left the European Union (EU) on 31 January 2020 and there is now a transition period until 31 December 2020. During this period all EU rules and laws apply to the UK. For citizens and businesses almost nothing will change during this period. This time it looks like there will be no extension of the transitional period. The UK has said it does not want an extension and it remains to be seen whether or not there will be a deal.

Deal or no-deal: customs formalities are an established fact. The current negotiations between the European Union and the UK are difficult. Clarity on the outcome is expected in the short term. Regardless of whether this results in a deal or a no-deal: from 1 January 2021, customs formalities will always apply to goods traded with the UK.

In recent months we as Mainfreight have therefore continued our preparations for the Brexit. We also have the ECMT permit which means that we can continue to drive to the UK with Mainfreight vehicles even in case of a no-deal Brexit with Mainfreight. We will also use the next 80 days to take care of final preparations. It’s now time to finalize the best solution together with you. We ask you to think about the incoterms and the execution of customs activities. Something where we also like to be of service to you.

Mainfreight, with its own customsteams, is your reliable partner for handling all your customs formalities. With our specialist knowledge we are able to offer solutions for all your customs obligations that match your logistic process. Mainfreight is AEO certified with which shipments subject to customs regulations are handled quickly and efficiently.

All you have to do is hand over your commercial invoice and packing list digitally and we take care of all customs formalities for you.

ICC Incoterms® 2020

In an international transaction, buyer and seller usually agree on an ICC Incoterms® 2020 rule. This determines the rights and obligations of both parties with regard to transport, insurance, permits and customs formalities. If you are not currently trading outside the EU, you may have agreed on conditions that are unfavorable after 1 January 2021. Therefore, please pay special attention to the application of the ICC Incoterms® 2020:

Ex Works (EXW)

The Incoterm® Ex Works (EXW) imposes the fewest obligations on the seller. All he has to do is place his goods at an agreed location - often his business premises, workshop or storage space - ready for the buyer.

EXW is an "unfriendly" Incoterm® for the buyer, because he has to arrange the entire transport himself. He bears all costs associated with transport to the final destination. He also bears the risk of loss or damage to the goods from the moment he takes delivery of the goods at the agreed place. The buyer is even responsible for loading the goods into the vehicle.

EXW is not suitable for export shipments. From October 1, 2020, the exporter named in the export declaration must be established in the EU. Therefore, the buyer from outside the EU will have to find another party, such as a logistics service provider or customs broker from the EU, willing to act as exporter for the export declaration.

It also applies that the buyer is responsible to EXW for arranging an export license or other export documents, should this be necessary.

Delivered At Place (DAP)

The Incoterm® Delivered At Place (DAP) entails many obligations for the seller. The seller arranges and pays for transportation to the agreed destination. He also bears the risk of loss or damage to the goods until he transfers the goods, not yet unloaded, to the buyer at this agreed place of destination (or place of delivery).

Describe at DAP the point within the agreed place of destination as clearly as possible. Because this is the place where the risk of loss or damage to the goods passes from the seller to the buyer (place of delivery). The buyer bears the costs of unloading at the agreed place of destination.

If the destination of the goods is outside the European Union (EU), the seller must arrange the export declaration with the customs. Furthermore, he is responsible for arranging an export license or other export documents, if necessary. For imports into the destination country, the buyer shall arrange customs formalities and payment of any import taxes. If necessary, the buyer also requests local import documents (e.g. an import permit).

Delivered Duty Paid (DDP)

The Incoterm® Delivered Duty Paid (DDP) brings with it most of the obligations for the seller. He arranges and pays for transportation to the agreed destination. He is responsible for customs clearance and pays any import duties in the destination country, such as import duties and/or import VAT. Furthermore, he bears the risk of loss or damage to the goods until he transfers the goods, not yet unloaded, to the buyer at the agreed place of destination (or place of delivery).

Please describe to DDP the point within the agreed place of destination as clearly as possible. Because this is the place where the risk of loss or damage to the goods passes from the seller to the buyer (place of delivery). The buyer bears the costs of unloading at the agreed place of destination.

At DDP, you are also responsible for customs clearance in the country of destination. In that case, you will bear the costs associated with customs clearance, including any import taxes due such as import duties, import VAT or other local import duties. You also have to provide any documents required to clear the goods, such as an import license.

Volumes and capacity Q4 2020

We are currently seeing an increase in volume from and to the United Kingdom among our customers. We expect 3 extra busy months of Brexit related volume. We ask you to inform us early on your increasing volumes so we can take this into account in our planning and capacity. Should it be the case that we cannot handle the increasing volumes in combination with the available capacity, we will inform you further.

What does all this mean for now? For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this.

Do you still have questions about the above information or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com.

Deal or no-deal: customs formalities are an established fact. The current negotiations between the European Union and the UK are difficult. Clarity on the outcome is expected in the short term. Regardless of whether this results in a deal or a no-deal: from 1 January 2021, customs formalities will always apply to goods traded with the UK.

In recent months we as Mainfreight have therefore continued our preparations for the Brexit. We also have the ECMT permit which means that we can continue to drive to the UK with Mainfreight vehicles even in case of a no-deal Brexit with Mainfreight. We will also use the next 80 days to take care of final preparations. It’s now time to finalize the best solution together with you. We ask you to think about the incoterms and the execution of customs activities. Something where we also like to be of service to you.

Advantages customs clearance by Mainfreight

Mainfreight, with its own customsteams, is your reliable partner for handling all your customs formalities. With our specialist knowledge we are able to offer solutions for all your customs obligations that match your logistic process. Mainfreight is AEO certified with which shipments subject to customs regulations are handled quickly and efficiently.

All you have to do is hand over your commercial invoice and packing list digitally and we take care of all customs formalities for you.

ICC Incoterms® 2020

In an international transaction, buyer and seller usually agree on an ICC Incoterms® 2020 rule. This determines the rights and obligations of both parties with regard to transport, insurance, permits and customs formalities. If you are not currently trading outside the EU, you may have agreed on conditions that are unfavorable after 1 January 2021. Therefore, please pay special attention to the application of the ICC Incoterms® 2020:

Ex Works (EXW)

The Incoterm® Ex Works (EXW) imposes the fewest obligations on the seller. All he has to do is place his goods at an agreed location - often his business premises, workshop or storage space - ready for the buyer.

EXW is an "unfriendly" Incoterm® for the buyer, because he has to arrange the entire transport himself. He bears all costs associated with transport to the final destination. He also bears the risk of loss or damage to the goods from the moment he takes delivery of the goods at the agreed place. The buyer is even responsible for loading the goods into the vehicle.

EXW is not suitable for export shipments. From October 1, 2020, the exporter named in the export declaration must be established in the EU. Therefore, the buyer from outside the EU will have to find another party, such as a logistics service provider or customs broker from the EU, willing to act as exporter for the export declaration.

It also applies that the buyer is responsible to EXW for arranging an export license or other export documents, should this be necessary.

Delivered At Place (DAP)

The Incoterm® Delivered At Place (DAP) entails many obligations for the seller. The seller arranges and pays for transportation to the agreed destination. He also bears the risk of loss or damage to the goods until he transfers the goods, not yet unloaded, to the buyer at this agreed place of destination (or place of delivery).

Describe at DAP the point within the agreed place of destination as clearly as possible. Because this is the place where the risk of loss or damage to the goods passes from the seller to the buyer (place of delivery). The buyer bears the costs of unloading at the agreed place of destination.

If the destination of the goods is outside the European Union (EU), the seller must arrange the export declaration with the customs. Furthermore, he is responsible for arranging an export license or other export documents, if necessary. For imports into the destination country, the buyer shall arrange customs formalities and payment of any import taxes. If necessary, the buyer also requests local import documents (e.g. an import permit).

Delivered Duty Paid (DDP)

The Incoterm® Delivered Duty Paid (DDP) brings with it most of the obligations for the seller. He arranges and pays for transportation to the agreed destination. He is responsible for customs clearance and pays any import duties in the destination country, such as import duties and/or import VAT. Furthermore, he bears the risk of loss or damage to the goods until he transfers the goods, not yet unloaded, to the buyer at the agreed place of destination (or place of delivery).

Please describe to DDP the point within the agreed place of destination as clearly as possible. Because this is the place where the risk of loss or damage to the goods passes from the seller to the buyer (place of delivery). The buyer bears the costs of unloading at the agreed place of destination.

At DDP, you are also responsible for customs clearance in the country of destination. In that case, you will bear the costs associated with customs clearance, including any import taxes due such as import duties, import VAT or other local import duties. You also have to provide any documents required to clear the goods, such as an import license.

Volumes and capacity Q4 2020

We are currently seeing an increase in volume from and to the United Kingdom among our customers. We expect 3 extra busy months of Brexit related volume. We ask you to inform us early on your increasing volumes so we can take this into account in our planning and capacity. Should it be the case that we cannot handle the increasing volumes in combination with the available capacity, we will inform you further.

Business as usual

What does all this mean for now? For the time being, you can continue to send shipments to and from the United Kingdom as usual. If there is more clarity about the exact details and consequences of the Brexit, we will inform you about this.

Contact

Do you still have questions about the above information or would you like to talk further about the Brexit? Please contact your account manager or our customs team at brexit@nl.mainfreight.com. Brexit Update 4 June 2019

You will not have missed it: the Brexit has been postponed again! Brexit would first take place on March 29 and later on April 12.

However, the 27 (permanent) EU countries and the British government have decided to postpone the Brexit date by 31 October 2019. Unfortunately, there is still a chance that it will ultimately not be possible to reach agreements with the United Kingdom about the Brexit. So a so-called no-deal Brexit can still take place with immediate return of customs procedures. If the British Parliament still agrees with the Brexit agreement before 31 October, the UK will leave the EU on the first day of the following calendar month (no later than 1 November 2019). From this withdrawal, a transition phase goes into effect until December 31, 2020. During this period, all EU rules and laws for the UK remain in force. Virtually nothing changes for citizens and businesses. This transition period may be extended once for two years if necessary until 31 December 2022.

The resignation of May puts an end to the British government's efforts to get the UK out of the EU with a deal before installing the new MEPs. This was still the hope of many Brexiteers.

So the Brexit soap is entering a new phase until 31 October. The chance of a no-deal and a tough Brexit has not decreased in any case. That is why it remains necessary to be Brexit ready. Mainfreight is still working hard to limit the inconvenience after a no-deal. However, it is important that your company continues to prepare for all scenarios, including a no-deal.

You can print, sign and return the authorization to us by mail (brexit@nl.mainfreight.com) or by post (Mainfreight, Customs team, Industriestraat 10, 7041 GD 's-Heerenberg, The Netherlands).

We have a Brexit FAQ page which we want to provide you with even more information. The Customs team of Mainfreight has a special team ready for all your questions about the Brexit. So do you want more information about the Brexit? Our specialists have the answer!

However, the 27 (permanent) EU countries and the British government have decided to postpone the Brexit date by 31 October 2019. Unfortunately, there is still a chance that it will ultimately not be possible to reach agreements with the United Kingdom about the Brexit. So a so-called no-deal Brexit can still take place with immediate return of customs procedures. If the British Parliament still agrees with the Brexit agreement before 31 October, the UK will leave the EU on the first day of the following calendar month (no later than 1 November 2019). From this withdrawal, a transition phase goes into effect until December 31, 2020. During this period, all EU rules and laws for the UK remain in force. Virtually nothing changes for citizens and businesses. This transition period may be extended once for two years if necessary until 31 December 2022.

The resignation of May puts an end to the British government's efforts to get the UK out of the EU with a deal before installing the new MEPs. This was still the hope of many Brexiteers.

So the Brexit soap is entering a new phase until 31 October. The chance of a no-deal and a tough Brexit has not decreased in any case. That is why it remains necessary to be Brexit ready. Mainfreight is still working hard to limit the inconvenience after a no-deal. However, it is important that your company continues to prepare for all scenarios, including a no-deal.

Direct representative

As an importer or exporter, determine whether you want to make Customs import or export declarations yourself after the Brexit, or whether you want to use Mainfreight for this. Mainfreight must then be authorized to arrange customs formalities for your company. You can arrange this authorization by signing our "Direct Representative" form and returning it to us. This authorization is revocable for you at any time.You can print, sign and return the authorization to us by mail (brexit@nl.mainfreight.com) or by post (Mainfreight, Customs team, Industriestraat 10, 7041 GD 's-Heerenberg, The Netherlands).

We have a Brexit FAQ page which we want to provide you with even more information. The Customs team of Mainfreight has a special team ready for all your questions about the Brexit. So do you want more information about the Brexit? Our specialists have the answer!

Brexit Updates

The Brexit has many consequences for your business. If you want more information, please leave your details here. We will gladly tell you more (without any obligation).